Past Conference

KFA-TFA Conference

The inaugural Korea Finance Association-Taiwan Finance Association Joint Conference in Finance was hosted by the TFA, and was held on September 24, 2011 at Taiwan National University in Taipei where each side presented 18 research papers. Following the footstep of a very successful inaugural KFA-TFA Joint Conference, KFA hosted the second KFA-TFA Joint Conference in September 14, 2012 in Seoul, Korea where each side presented 15 research papers.

While the KFA had a lofty vision of organizing multilateral international conferences of the Allied Asian Finance Associations initially, KFA has a more modest goal of promoting interaction amongst Asian finance scholars through holding an annual academic conference where the members of partner finance associations get to present their research papers for a high quality feedback. This conference will provide a great opportunity for members of KFA and TFA to discuss and exchange perspectives on the ongoing important issues in financial markets in Asia and worldwide. We also welcome any and everyone who wishes to network with the members of KFA and TFA as well as to get to know the research works conducted by the members of KFA and TFA.

In this second KFA-TFA Joint Conference, 30 papers was presented in 10 sessions. These papers were selected from papers submitted by the members of KFA and TFA through blind peer-review process. The selected papers exhibit high standards of academic quality and discuss a wide range of exciting topics. Among these papers, four papers will be awarded as Best Papers.

We would like to express our heartfelt gratitude to all the sponsors who provided generous support for the conference. I would also like to express my deepest appreciation to the members of this year’s Review Committee who evaluated the academic paper submissions.

2012 Organizing Committee

KFA

| Seokchin Kim | Kyungpook National University | KFA President |

| Dongcheol Kim | Korea University | KFA President-Elect |

| Yun Woo Park | Chung-Ang University | KFA Organizing Committee Co-Chair |

| Chang-Soo Kim | Yonsei University | KFA Organizing Committee Co-Chair |

| Jhinyoung Shin | Yonsei University | KFA Review Committee Chair |

TFA

| Schive Chi | Taiwan Stock Exchange Corporation | TFA President |

| Simon Yeh | National Cheng-Chi University | TFA Organizing Committee Co-Chair |

| Min-Teh Yu | National Chiao Tung University | TFA Organizing Committee Co-Chair |

| Robin K. Chou | National Cheng-Chi University | TFA Review Committee Chair |

| Shing-Yang Hu | National Taiwan University | TFA Review Committee |

Call for Papers

2012 KFA-TFA Joint Conference in Finance

Seoul, Korea, September 14, 2012

Korean Finance Association (KFA) and Taiwan Finance Association (TFA) invite interested scholars and practitioners, who are members of each Association, to submit research papers for presentation at the Korean Finance Association - Taiwan Finance Association Joint Conference to be held at the Education Center of KOFIA (Korea Financial Investment Association) in Seoul, Korea on September 14, 2012. A total of 15 papers selected from Korea will be presented at the Conference, along with another 15 papers selected from Taiwan. We welcome submissions of quality research papers, both theoretical and empirical, on all topics in finance.

SUBMISSION PROCEDURE

Seoul, Korea, September 14, 2012

Korean Finance Association (KFA) and Taiwan Finance Association (TFA) invite interested scholars and practitioners, who are members of each Association, to submit research papers for presentation at the Korean Finance Association - Taiwan Finance Association Joint Conference to be held at the Education Center of KOFIA (Korea Financial Investment Association) in Seoul, Korea on September 14, 2012. A total of 15 papers selected from Korea will be presented at the Conference, along with another 15 papers selected from Taiwan. We welcome submissions of quality research papers, both theoretical and empirical, on all topics in finance.Interested authors should electronically submit drafts of completed papers (or an incomplete draft, which can be completed by the end of August, 2012), written in English and prepared in either Microsoft Word or pdf format, to:

KFA Members/ Email: office@korfin.org

TFA Members/ Email: syhu@ntu.edu.tw

*prof. Shing-Yang Hu (TFA Review Committee)

The deadline for submission is July 20, 2012.

Submissions will be subject to blind review. The result of the review will be notified to the authors via e-mail by July 31, 2012.

BEST PAPER AWARDS

Two best papers, one from each finance association, will be selected for research awards of USD 1,000. The awards will be announced at the Conference. The awarded papers will be invited to be published in the Asian Review of Financial Research (ARFR), the official journal of the KFA.

ASIAN REVIEW OF FINANCIAL RESEARCH

Authors whose papers are accepted for presentation at the Conference are encouraged to submit their papers for publication in the ARFR. For conference papers submitted for the ARFR, the journal submission fee of USD70 (or KRW70,000) will be waived. The papers will also undergo the fast-track review process, which guarantees the completion of the first-round review in three weeks.

Asian Review of Financial Research (ARFR), formerly known as The Korean Journal of Finance, publishes original reports of academic research, both theoretical and empirical, on the Asia-Pacific capital markets. The journal covers all areas of finance including corporate finance, investments, banking, international finance, and derivative securities. The journal is published quarterly in February, May, August, and November. For more information on the ARFR, please visit the journal website at:

Journal URL: http://www.korfin.org/english/journal.html

FURTHER INFORMATION

For additional information regarding the conference, please contact:

Jhin Young Shin (Yonsei University), Review Committee Chair (jshin@yonsei.ac.kr, 02-2123-5467)

Yun Woo Park (Chung-Ang University), Program Co-Chair (yunwpark@cau.ac.kr, 02-820-5793)

Chang-Soo Kim (Yonsei University), Program Co-Chair (kimc@yonsei.ac.kr, 033-760-2331)

Seokchin Kim, President, Korea Finance Association

◆ Program

2012 KFA&TFA Joint Conference in Finance

September 14, 2012 (Friday)

Location: 7F/8F, Korea Institute of Financial Investment

| Time | Sessions & Places | ||||

| 13:00~13:30 | Registration | ||||

| 13:30~13:40 | Opening Ceremony Seokchin Kim (KFA President) Min-Teh Yu (TFA Director) [Room 701] |

||||

| 13:40~13:50 | Best Paper Awards [Room 701] |

||||

| 13:55~15:10 | Academic Session(#1) Corporate Finance [Room 701] |

Academic Session(#2) Investments [Room 702] |

Academic Session(#3) Corporate Finance [Room 703] |

Academic Session(#4) Investments [Room 802] |

Academic Session(#5) Financial Derivatives [Room 803] |

| 15:10~15:25 | Coffee Break | ||||

| 15:25~16:40 | Academic Session(#6) Corporate Finance [Room 701] |

Academic Session(#7) Investments [Room 702] |

Academic Session(#8) Corporate Finance [Room 703] |

Academic Session(#9) Investments [Room 802] |

Academic Session(#10) Mixed Topics [Room 803] |

| 16:50~17:20 | Financial Village (4th Floor) | ||||

◆ Accepted Papers

| Session | Field | Paper Title | Paper Title |

| Session 1 | Corporate Finance |

Does Improved Corporate Governance Induce Foreign Investors, Resulting in Better Corporate Performance? The Case of Korea | Sun-Wung Hwang (Chung-Ang Univ.) Yu Rim Jung (Chung-Ang Univ.) |

| Market Reaction, Revised Proceeds, and the Classification of Seasoned Equity Offerings | Konan Chan (National Chengchi Univ.) Nandkumar Nayar (Lehigh Univ.) Ajai K. Singh (Lehigh Univ.) Wen Yu (Univ. of St. Thomas) |

||

| A J-Shaped Cross-Sectional Relation Between Dividends and Firm Value | Soojung Kim (Kyung Hee Cyber Univ.) Jungwon Suh (Sungkyungkwan Univ.) |

||

| Session 2 | Investment | Trading Responses to Analyst Reports by Investor Types: Korean Evidence | Kyung Soon Kim(Hankuk Univ. of Foreign Studies) Yun Woo Park (Chung-Ang Univ.) Jin Woo Park(Hankuk Univ. of Foreign Studies) |

| Mutual Funds Herding under Financial Crises:Evidence from Taiwan Stock Markets | Yu-Fen Chen (Da-Yeh Univ.) Sheng-Yung Yang(National Chung-Hsing Univ.) Fu-Lai Lin (Da-Yeh Univ.) |

||

| Session 3 | Corporate Finance |

Do Institutional Investors Monitor Management? Evidence from the Association between Institutional Ownership and Capital Structure | Chune Young Chung (Kookmin Univ.) |

| IPO Underwriting and Subsequent Lending | Hsuan-Chi Chen (Univ. of New Mexico) Li-Ping Chen (Yuan Ze Univ.) Keng-Yu Ho (National Taiwan Univ.) Pei-Shih Weng (National Central Univ.) |

||

| Congruence within the Top Management: How "Old Boy Network" Affects Executive Appointment and Performance | Daemin Ahn (Korea Univ.) Woojin Kim (Seoul National Univ.) Eun Jung Lee (Hanyang Univ.) Kyung Suh Park (Korea Univ.) |

||

| Session 4 | Investment | The Effectiveness of Position Limits: Evidencefrom the Foreign Exchange Futures Markets | Ya-Kai Chang (National Chengchi Univ.) Yu-Lun Chen (Chung Yuan Christian Univ.) Robin K. Chou (National Chengchi Univ.) |

| Market Segmentation, Price Disparity and Transmission of Pricing Information: Evidence from Class A and H Shares of Chinese Dual-Listed Companies | Kyung-Won Kim (Kyonggi Univ.) Yong Hyeon Kim (Hanyang Cyber Univ.) |

||

| Market Efficiency and Stability under Short-Sale Constraints: Evidence from Taiwan | Jin-Huei Yeh (National Central Univ.) Lien-Chuan Chen (National Central Univ.) |

||

| Session 5 | Investment Financial Derivativest |

Constraints: Evidence from Taiwan Volatility Information in the Trading Activity of Stocks, Options and Volatility Options |

Yaw-Huei Wang (National Taiwan Univ.) |

| A Unified Model: Arbitrage-free Term Structure Movements of Flow Risks | Thomas S. Y. Ho (Thomas Ho Co., Ltd.) Sang Bin Lee (Hanyang Univ.) |

||

| Pricing Range Accrual Notes in an Affine Term Structure Model with Stochastic Mean, Stochastic Volatility and Jumps | Shaoyu Li (Xiamen Univ.) Henry H. Huang (National Central Univ.) Li-Chuan Tsai (Xiamen Univ.) |

||

| Session 6 | Corporate Finance |

Acquire to Kill: Evidence from "Real" Corporate Raiders | Hee Sub Byun (Korea Univ.) Woojin Kim (Seoul National Univ.) Eun Jung Lee (Hanyang Univ.) Kyung Suh Park (Korea Univ.) |

| The Information Content of R&D Reductions | Yanzhi Wang (National Taiwan Univ.) Konan Chan (National Chengchi Univ.) Yueh-Hsiang Lin(National Taipei College of Business) |

||

| Corporate Governance and Payout Policy: Evidence from Korean Business Groups | Lee-Seok Hwang (Seoul National Univ.) Hakkon Kim (KAIST) Kwangwoo Park (KAIST) Raesoo Park (Sookmyung Women's Univ.) |

||

| Session 7 | Investment | The Liquidity and Volatility Impacts of Day Trading by Individuals in the Taiwan Index Futures Market | Robin K. Chou (National Chengchi Univ.) George H.K. Wang (National Chengchi Univ.) Yun-Yi Wang (Feng-Chia Univ.) |

| Flight-to Quality and Correlation between Currency and Stock Returns | Jin-Wan Cho (Korea Univ.) Joung Hwa Choi (Seoul National Univ.) Taeyong Kim (Morningstar Associates Korea) Woojin Kim (Seoul National Univ.) |

||

| Does the Value Spread Predict International Stock Returns? | Yu-Ru Huang (National Chi Nan Univ.) Kuan-Cheng Ko (National Chi Nan Univ.) Hsiang-Tai Lee (National Chi Nan Univ.) Shinn-Juh Lin (National Chengchi Univ.) |

||

| Session 8 | Corporate Finance |

How Does the Financial Policy Affect Enterprise Value Having Different Growth Opportunity? An Empirical Study on Growth Opportunities, Financial Policy, and Enterprise Value of Korean Listed Companies | Doowon Ryu (Chung-Ang Univ.) Doojin Ryu (Chung-Ang Univ.) Jinyong Yang (Hanyang Univ.) |

| Stock Market Valuation of R&D Expenditure and Corporate Governance | Hung-Kun Chen (Tamkang Univ.) Li-Hong Hong (Yuan Ze Univ.) Yanzhi Wang (Yuan Ze Univ.) |

||

| Valuation of Insurers' Contingent Capital with Counterparty Risk and Price Endogeneity | Jin-Ping Lee (Feng Chia Univ.) Chien-Ling Lo (National Taiwan Univ.) Min-Teh Yu (National Chiao Tung Univ.) |

||

| Session 9 | Investment | Investor Sentiment from Internet Message Postings and Predictability of Stock Returns | Dongcheol Kim (Korea Univ.) Soon-Ho Kim (Korea Univ.) |

| Credit Rating Anomaly in Taiwan Stock Market | Kuan-Cheng Ko (National Chi Nan Univ.) Shinn-Juh Lin (National Chengchi Univ.) Hsiang-Hui Chu (National Chi Nan Univ.) Hsiao-Wei Ho (National Central Univ.) |

||

| Attention effect on the ex date: Evidence from Taiwan | Shing-Yang Hu (National Taiwan Univ.) Yun-Lan Tseng(National Ping Tung Institute of Commerce) |

||

| Session 10 | Mixed Topics |

Too Many To Fail: The Effect of Regulatory Forbearance on Market Discipline | Wook Sohn (KDI School of Public Policy and Management) Hyosoon Choi(Korea Deposit Insurance Corporation) |

| Do Implied Put and Call Sneers Contain Different Information? | Youngsoo Choi(Hankuk Univ. of Foreign Studies) Steven J. Jordan (Econometric Solutions) Wonchang Lee(Hi Investment &Securities Co., Ltd.) |

||

| Which Liquidity Proxy Measures Liquidity Best in Emerging Markets? | Hee-Joon Ahn (Sungkyunkwan Univ.) Jun Cai (City Univ. of Hong Kong) Cheol-Won Yang (Dankook Univ.) |

◆ Place or Location

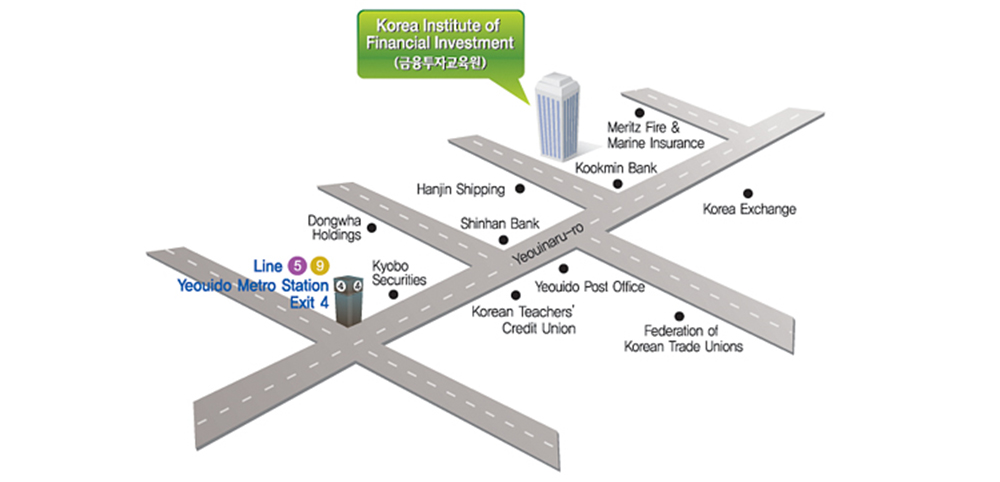

Conference Venue : Korea Institute of Financial Investment

Address: (street based address) 67-8 Yeouinaru-ro, Yeongdeungpo-gu, Seoul (administrative unit based address) Kyeong-ho Building, 25-2 Yeouido-dong, Yeongdeungpo-gu, Seoul

Direction using Metro: Take either Metro 5 or 9; get off at Yoido Metro Station; take Exit 4; walk two blocks (250m) toward KRX (Korea Exchange Building); facing the Kookmin Bank branch at the corner turn left; walk another 50 meters to The Korea Institute of Financial Investment

◆ Hotel Information

| Marriott Executive Apartments | Courtyard Seoul Times Square |

| Lexington Hotel | http://www.thelexington.co.kr/ |

| Three Seven Stay Hotel | http://www.three7stay.com/ |

| Yoido Hotel | http://www.yoidohotel.co.kr/ |

| Courtyard Seoul Times Square | http://www.courtyardseoul.com/ |

◆ Contact

Contact : Prof. Yun Woo Park (Chung-Ang University)

E-mail : yunwpark@cau.ac.kr

TEL : 82-2-820-5793

[ 07327 ] 67-8, Yeouinaru-ro, Yeongdeungpo-gu, Seoul, Korea TEL. +82-2-2003-9921 FAX. +82-2-2003-9979 E-mail. office@korfin.org

COPYRIGHT(C) SINCE 1987 KOREAN FINANCE ASSOCIATION. All rights reserved.